Nov, 10 2025

Nov, 10 2025

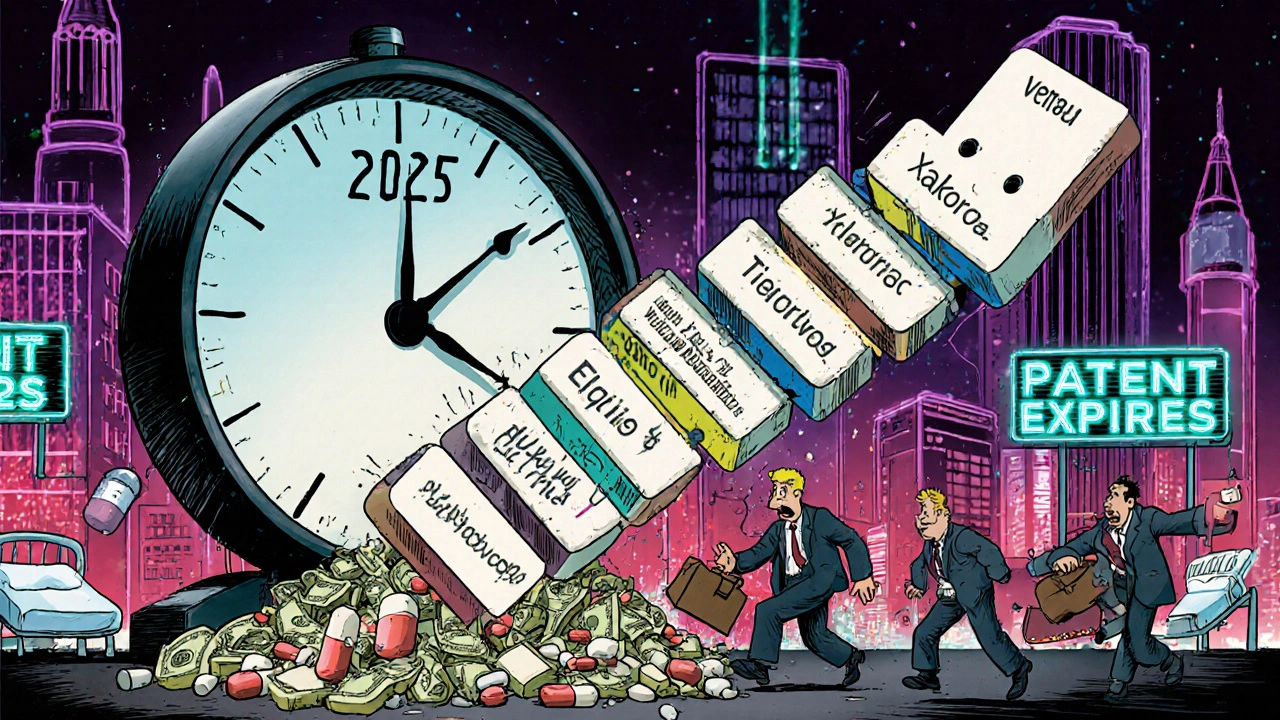

What’s Really Happening in 2025? The Biggest Drug Patent Expirations Ever

By mid-2025, the pharmaceutical world will face its most disruptive wave of patent expirations in history. This isn’t just about one or two drugs losing protection - it’s about 65 major drugs hitting their patent end dates in a single year, with dozens more following through 2030. These aren’t obscure medications. These are the billion-dollar blockbusters that doctors prescribe every day - drugs that keep millions alive, manage chronic pain, and treat cancer. And when their patents expire, everything changes: prices drop, generics flood the market, and healthcare systems scramble to adapt.

For patients, this could mean paying half or even a tenth of what they used to. For pharmacies, it’s a logistical nightmare of inventory shifts and patient counseling. For drugmakers like Merck, Pfizer, and Novartis, it’s a financial earthquake. And it’s all starting now.

2025: The First Domino Falls - Entresto, Xalkori, and Ticagrelor

July 2025 is the first major checkpoint. That’s when Novartis’s Entresto (sacubitril/valsartan) loses exclusivity. This heart failure drug brought in $7.8 billion in 2024. It’s prescribed in hospitals and clinics across the U.S., and its patent expiration means generic versions can hit shelves within months. Hospitals are already preparing formulary changes. Pharmacists are training staff on substitution rules - because in 42 states, pharmacists can switch patients to a biosimilar or generic without a new prescription.

Right after Entresto, two more drugs follow:

- Xalkori (crizotinib), Pfizer’s lung cancer treatment, loses two key patents in March and August 2025. Its sales were $524 million in 2018 - and while those numbers have shifted, the loss of protection still opens the door for generic competitors.

- Ticagrelor (Brilinta), AstraZeneca’s blood thinner, has its solid oral formulation patent expire in May 2025. This is a big deal for patients with heart disease who take it daily. A generic version could cut the monthly cost from $300 to under $30.

And don’t forget Omegaven (fish oil triglycerides), used in hospital nutrition. Two patents expire July 11, 2025. It’s not a household name, but in ICU units, it’s essential. When generics arrive, hospitals will save millions.

2026-2028: The Big Guns - Eliquis, Opdivo, and Keytruda

2025 is just the warm-up. The real financial bloodbath starts in 2026 with Eliquis (apixaban). Co-marketed by Bristol Myers Squibb and Pfizer, this blood thinner generated over $13 billion in sales for BMS alone in 2024. It’s prescribed to millions of atrial fibrillation patients to prevent strokes. When generics come in - likely by late 2026 - price drops of 80-90% are expected. That’s not speculation. That’s what happened with Lipitor in 2011. Within six months, generics captured 80% of the market.

Then comes Opdivo (nivolumab), another cancer drug from BMS. Its patent expires in 2028. While not as big as Eliquis, it’s still a $5 billion+ drug. Biosimilars will enter slowly - oncology drugs take longer to adopt because doctors are cautious. But they will come.

But nothing compares to Keytruda (pembrolizumab). Merck’s cancer immunotherapy brought in $29 billion in 2024. That’s 40% of Merck’s entire pharmaceutical revenue. Its patent expires in 2028. This isn’t just a drug losing protection - it’s the collapse of a revenue pillar. Analysts estimate biosimilar versions could cut Keytruda’s sales by 60-70% within three years. Merck is already investing billions in new therapies, but nothing will replace that kind of income overnight.

Why This Patent Cliff Is Different - It’s Mostly Biologics

Previous patent cliffs - like Lipitor in 2011 - were about small-molecule drugs. Those are chemically synthesized pills. Easy to copy. Fast to approve. Generic versions showed up within weeks, and prices crashed.

This time, it’s mostly biologics. These are complex, living-molecule drugs made from living cells. Think of them as protein-based therapies - like Keytruda, Humira, and Eylea. Copying them isn’t like copying aspirin. You can’t just make an exact replica. You make a biosimilar - a very close, but not identical, version. The FDA approval process is longer, more expensive, and more cautious.

That means:

- Biosimilars take 6-12 months longer to appear after patent expiry than traditional generics.

- Price discounts start smaller - 20-35% instead of 80%.

- Doctors are slower to switch. Patients are reluctant to change. Insurance companies have to renegotiate contracts.

But the long-term impact is still massive. Humira’s biosimilars didn’t take over until 2023 - three years after its patent expired. By late 2023, they held 35% of the market. And prices dropped 30%. Keytruda and Eliquis will follow the same pattern - just on a much larger scale.

Who’s Getting Hit the Hardest?

Here’s the short list of companies facing the biggest revenue losses through 2029:

- Merck - Keytruda ($29B)

- Bristol Myers Squibb - Eliquis ($13B+), Opdivo ($5B+)

- Novartis - Entresto ($7.8B)

- Amgen - Enbrel, Prolia/Xgeva

- Regeneron - Eylea

- Pfizer - Xalkori, Eliquis (co-marketed)

- Janssen (Johnson & Johnson) - Xarelto

- Eli Lilly - Trulicity

These companies aren’t just losing sales. They’re losing the funding for future R&D. Many are already shifting focus to gene therapies, RNA drugs, and AI-designed molecules - areas where patent protection can last longer. In fact, 42% of Big Pharma’s late-stage pipelines now focus on these next-gen therapies, up from 27% in 2020.

What This Means for Patients and Pharmacists

If you’re taking one of these drugs, your out-of-pocket cost could drop dramatically - but not instantly. There’s often a 6-9 month lag between patent expiry and generic availability. Why? Regulatory delays. FDA approvals. Manufacturing ramp-up. You can’t just print a new pill overnight.

Pharmacists are on the front lines. They’re spending 2-3 extra minutes per patient documenting switches. They’re counseling patients who worry generics won’t work as well. One community pharmacist in New York reported a 25% increase in counseling time during previous transitions. And it’s not just about price. Some states allow automatic substitution of biosimilars. Others require the prescriber to specifically approve the switch. That’s a legal minefield.

But here’s the good news: lower prices mean better adherence. WPRX found that cutting prescription costs in half increases patient adherence by 30%. Fewer missed doses. Fewer hospital visits. Better outcomes. That’s the real win.

What’s Next? The Long Game Through 2030

The patent cliff doesn’t end in 2025. It’s a decade-long event. By 2030, patents for nearly every major biologic will have expired. The IMS Institute for Healthcare Informatics predicts $192 billion in U.S. drug spending reductions between 2025 and 2029. The Congressional Budget Office estimates Medicare Part D will save $44 billion annually by 2030.

That money doesn’t disappear - it gets redirected. More patients get treated. More people stick to their meds. More hospitals can afford new equipment. Generic manufacturers are expanding capacity. New players from India and China are entering the U.S. market.

But the biggest change? The end of the era where one drug could fund a company’s entire future. The days of billion-dollar blockbusters dominating the market are fading. The future belongs to competition, affordability, and access.

Elliott Jackson

November 11, 2025 AT 13:53McKayla Carda

November 13, 2025 AT 10:10Christopher Ramsbottom-Isherwood

November 14, 2025 AT 00:22Stacy Reed

November 14, 2025 AT 21:29Robert Gallagher

November 15, 2025 AT 17:20Howard Lee

November 15, 2025 AT 21:31Nicole Carpentier

November 17, 2025 AT 13:41