Dec, 20 2025

Dec, 20 2025

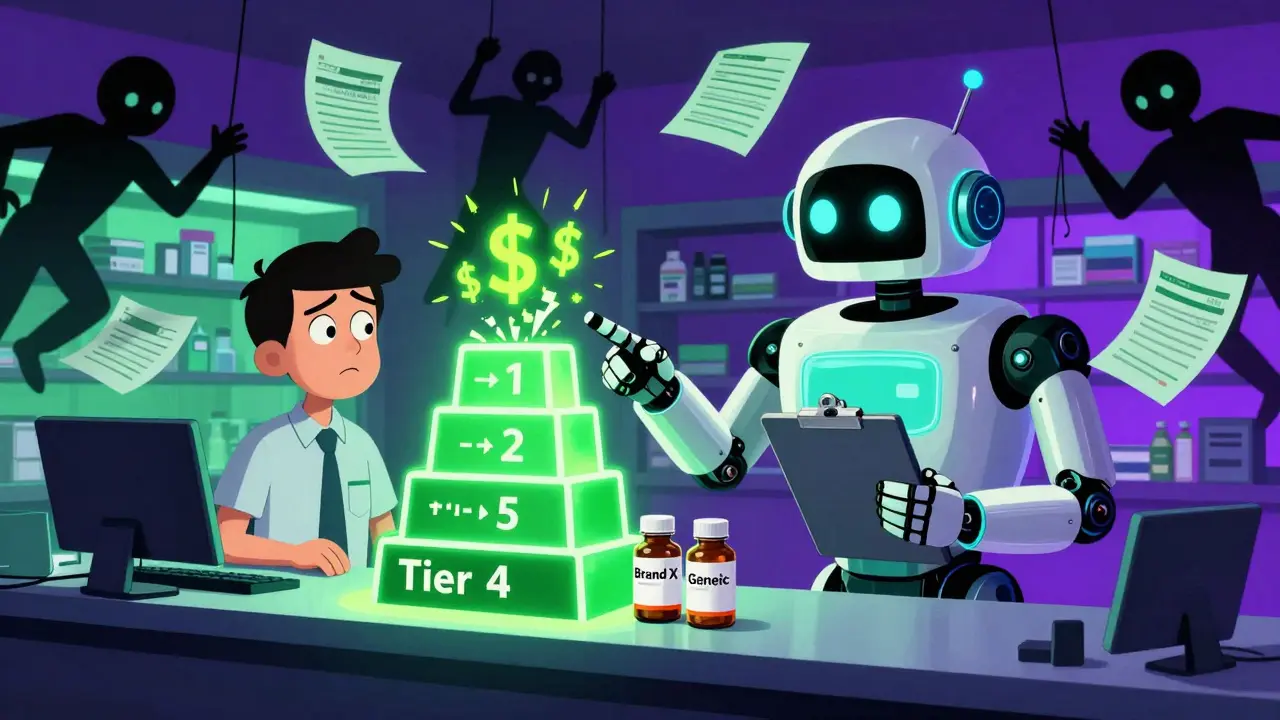

When you pick up a prescription at the pharmacy, you might not think about why your $10 copay covers your blood pressure med, but your asthma inhaler costs $75. The reason lies in something most employees never see: your employer’s formulary. It’s not just a list of covered drugs-it’s a complex system designed to control costs, and it’s pushing you toward generics without always telling you why.

How Formularies Work: The Hidden Rules Behind Your Copay

Your employer’s health plan doesn’t just pay for drugs. It organizes them into tiers, like a pricing ladder. Tier 1 is for generics-usually $10 or less. Tier 2 is for preferred brand-name drugs-often $40. Tier 3 is for non-preferred brands-$75 or more. And Tier 4? That’s for specialty drugs, like biologics for rheumatoid arthritis or diabetes, where you might pay 30% of the cost-sometimes hundreds of dollars a month. This isn’t random. Pharmacy Benefit Managers (PBMs) like OptumRx, CVS Caremark, and Express Scripts manage these tiers for your employer. When a brand-name drug loses its patent and a generic hits the market, the PBM automatically moves the generic to Tier 1 and pushes the brand version to Tier 4. That means if you keep taking the brand, your out-of-pocket cost jumps-sometimes by 700%. And it’s not just about price. The FDA confirms that generic drugs are just as safe and effective as brand-name versions. They contain the same active ingredients, work the same way, and are held to the same manufacturing standards. The only real difference? Generics cost 80-85% less because they don’t need to repeat expensive clinical trials or run national ad campaigns.Why Your Employer Pushes Generics (And Why It Matters to You)

Employers aren’t doing this to be stingy-they’re doing it to survive. Prescription drug costs have been rising faster than wages for over a decade. According to Schauer Group, generic drugs save the U.S. healthcare system more than $150 billion every year. That’s $3 billion a week. Large employers (99% of them, according to Kaiser Family Foundation) include prescription drug coverage because it’s expected. But they’re under pressure to keep premiums low. One of the most effective ways to do that? Get employees to use generics. Here’s the catch: many employees don’t know generics are safe. Some still believe they’re “weaker” or “made in cheaper factories.” Others simply don’t realize their insulin, statin, or antidepressant has a generic version available. That’s why smart employers run education campaigns-through payroll stuffers, emails, or even HR town halls-to explain that switching to a generic isn’t a compromise. It’s a smarter choice.

What Happens When Your Drug Gets Removed From the Formulary

In January 2024, each of the three biggest PBMs removed over 600 drugs from their formularies. That’s more than 1,800 medications suddenly not covered. These aren’t obscure drugs. Many are common treatments for high blood pressure, cholesterol, asthma, and diabetes. Why? It’s a negotiation tactic. PBMs use exclusions to pressure drugmakers into offering bigger rebates. If a drug isn’t on the formulary, the pharmacy won’t pay for it unless you pay full price-or your doctor gets a prior authorization exception. If your medication gets pulled, you have options:- Ask your doctor if there’s a generic or alternative on the formulary.

- Request a medical exception from your insurer. You’ll need documentation showing why the excluded drug is medically necessary.

- Use your employer’s care management program-many offer free health coaches who help you find affordable alternatives.

The Rebate Black Box: Why Savings Don’t Always Reach You

Here’s the part no one talks about: the savings from generics and rebates often don’t show up in your wallet. PBMs use a system called gross-to-net (GTN) pricing. A drug might have a list price of $100, but after rebates, discounts, and returns, the PBM only pays $45. That 55% difference? That’s the GTN spread-and it’s where most of the profit hides. The problem? That rebate goes to the PBM, not to you. So even though your employer is saving money, your copay might stay the same. In some cases, PBMs even keep the brand-name drug on the formulary (at a high tier) because the rebate is too good to pass up. That’s why some experts call it a broken system. You’re being nudged toward generics to save money, but the real savings are being captured by middlemen-not passed on to you.

How to Take Control of Your Prescription Costs

You don’t have to be passive in this system. Here’s what you can do right now:- Check your plan’s formulary-visit your insurer’s website and search for your medication. Look for the tier and copay.

- Ask about generics-if your doctor prescribes a brand-name drug, ask: “Is there a generic version?” If yes, request it.

- Use in-network pharmacies-some employers have programs like HealthOptions.org’s Price Assure Program, which automatically lowers the price of generics at in-network pharmacies.

- Use your Summary of Benefits and Coverage (SBC)-it’s required by law to include a drug coverage section. Find it in your benefits portal.

- Call your insurer-if you’re unsure, don’t guess. Ask: “Is this drug covered? What’s my copay? Is there a cheaper alternative?”

What’s Changing in 2025 and Beyond

The trend is clear: employers will keep pushing generics. PBMs will keep using exclusions as leverage. And drugmakers will keep fighting back with rebates and legal challenges. But there’s growing pressure for transparency. States are starting to regulate how PBMs use rebates. The federal government is watching. And employees are asking more questions. In the next few years, we’ll likely see:- More employers requiring generics for chronic conditions unless medically unnecessary.

- Formularies becoming even more restrictive-fewer brand-name options.

- More tools for employees to compare drug prices in real time through employer apps.

- Greater scrutiny of the GTN spread, possibly leading to rebates being passed directly to consumers.

Are generic drugs really as good as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also meet the same strict manufacturing standards. The only differences are in inactive ingredients (like fillers) and packaging. Generics are tested to ensure they work the same way in the body. Over 90% of all prescriptions filled in the U.S. are generics-and they’re used safely by millions every day.

Why does my copay go up when a generic becomes available?

It shouldn’t. When a generic becomes available, the brand-name version is usually moved to a higher tier (like Tier 4), which increases your cost if you choose to stay on it. Your copay for the generic should be lower-often $10 or less. If your copay went up after a generic launched, you may be accidentally filling the brand-name version. Check your prescription label or ask your pharmacist.

What if my medication is no longer on the formulary?

You have a few options. First, ask your doctor if there’s a similar drug on the formulary. If not, your doctor can submit a prior authorization request to your insurer, explaining why the excluded drug is medically necessary. Some employers also have care management teams who can help you navigate this process. Don’t stop taking your medication-act quickly.

Do all employer health plans have the same formulary?

No. Formularies vary by insurer, PBM, and even by the specific plan your employer chose. One company might use Anthem’s Select Drug List, while another uses OptumRx’s National Direct Preferred list. Even within the same insurer, different tiers and exclusions can apply. Always check your own plan’s formulary, not your coworker’s.

Can I get a cheaper price if I pay cash instead of using insurance?

Sometimes. For some generics, especially older medications like metformin or lisinopril, the cash price at Walmart, Target, or Costco can be as low as $4-$10 for a 30-day supply-sometimes cheaper than your insurance copay. Use apps like GoodRx or SingleCare to compare prices before filling your prescription. But for specialty drugs or newer medications, insurance will almost always be cheaper.

How often do formularies change?

All the time. New generics enter the market every month. PBMs update formularies quarterly, sometimes monthly. A drug you had last month might be removed next month. There’s no advance notice required. That’s why it’s critical to check your formulary before refilling prescriptions-especially if you’re on a long-term medication.

Jerry Peterson

December 21, 2025 AT 02:00I used to think generics were sketchy until my dad switched from Lipitor to atorvastatin and saved $80 a month. Same pill, same results. Now he laughs at people who pay full price for brand names. Just check your label next time you pick up a script.

Meina Taiwo

December 22, 2025 AT 02:52Generics work. Simple.

Stacey Smith

December 23, 2025 AT 01:03This system is rigged. PBMs are corporate vultures and employers are complicit. We’re supposed to be grateful for being nudged toward cheaper meds while the middlemen pocket the difference. Wake up, America.

Ben Warren

December 23, 2025 AT 14:53It is imperative to acknowledge that the structural inefficiencies inherent in the Pharmacy Benefit Manager ecosystem represent a profound misalignment of incentives. The gross-to-net pricing mechanism, while mathematically transparent to actuaries, is ethically indefensible when the savings are not passed to the end consumer. Furthermore, the regulatory lacunae permitting such practices constitute a failure of both market discipline and fiduciary oversight. Employers, as fiduciaries of employee welfare, must demand transparency, and patients must be empowered with accessible, real-time pricing data to mitigate the exploitative dynamics currently in play.

Christina Weber

December 24, 2025 AT 05:25Actually, the FDA requires generics to be bioequivalent, not just ‘the same.’ That means they must have the same rate and extent of absorption. Many people don’t realize that. Also, ‘inactive ingredients’ can cause reactions in sensitive individuals-so it’s not always just packaging. But for 99% of people, generics are perfectly safe and effective.

Cara C

December 25, 2025 AT 00:12If you’re on a chronic med and your copay jumped, don’t panic. Call your pharmacy first-sometimes they’ll switch you to the generic without you even asking. And if your doctor says ‘no generic,’ ask why. Sometimes it’s habit, not science. I helped my mom switch from brand-name asthma inhaler to generic and she saved $120/month. No side effects. Just cheaper.

Michael Ochieng

December 26, 2025 AT 15:17Just came back from Nigeria last month-there, generics are the norm because brand names are way too expensive. People here act like switching is a betrayal, but it’s just smart economics. We’re all paying for the same drug, just with different labels. Maybe we need more global perspective on this.

Grace Rehman

December 28, 2025 AT 04:04So let me get this straight-we’re supposed to be grateful that our employer is saving money by forcing us to take cheaper pills while the middlemen get rich off the difference? And the FDA says it’s fine? Cool. I’ll just take my $4 metformin from Costco and pretend the system isn’t designed to make me feel guilty for wanting to live without bankruptcy

Southern NH Pagan Pride

December 29, 2025 AT 13:21They’re putting microchips in generics to track us. The PBM’s are owned by the same folks who run the FDA. You think the ‘same active ingredients’ thing is real? Nah. They swap out the stuff you need and replace it with fillers that make you tired. Look up the 2022 Senate hearing they buried. They don’t want you to know you’re being dosed with surveillance chemicals.

Orlando Marquez Jr

December 31, 2025 AT 11:22It is noteworthy that the formulary management practices described herein reflect a broader trend toward cost-containment strategies in employer-sponsored health plans. The utilization of tiered formularies and PBM-driven exclusions is a well-documented mechanism for controlling pharmaceutical expenditures. However, the absence of patient-centered rebate transparency remains a critical deficiency in the current model. Employers would benefit from adopting value-based formulary design frameworks that prioritize clinical outcomes alongside cost efficiency.

Jackie Be

January 1, 2026 AT 00:31OMG I just found out my $75 insulin is a brand and there’s a generic for $12?? I’ve been paying like a sucker for 3 years. I’m calling my doctor right now. Also why does my insurance not tell me this?? I’m so mad I could scream. THANK YOU for this post. I’m sharing it with everyone I know